Managing money isn’t just about earning more—it’s about controlling what goes out of your wallet. Many people set up budgets but struggle to stick to them because they don’t truly understand where their money is going. Tracking your spending is the first, and perhaps most powerful, step to taking control of your finances.

As a financial advisor, I recommend that you treat expense tracking as your financial “fitness plan.” Just like monitoring your calories helps with weight loss, tracking your spending helps you cut unnecessary costs and grow your savings. Let’s dive into a simple, practical approach to track your spending, beat your budget, and start saving money today.

Why Tracking Your Spending Matters

- Awareness is Power: Many people underestimate how much they spend on little things. A $5 coffee every weekday adds up to over $100 a month. When you write down or log every expense, you start noticing these hidden costs. This awareness alone can stop you from making thoughtless purchases and put you back in control.

- Better Budgeting: A budget is only as good as the information you base it on. If you don’t know how much you’re really spending, your budget will be unrealistic and hard to follow. Tracking helps you see the exact numbers, so your budget is grounded in reality rather than guesswork. That makes it easier to stick with the long-term.

- Identifying Waste: Many people continue paying for services or subscriptions they no longer use. Tracking helps you spot these unnecessary expenses. For example, if you realize you’re spending $50 a month on subscriptions you forgot about, that’s $600 a year you could redirect toward savings or debt repayment.

- Faster Savings: When you track and trim your spending, the extra money can immediately be put to work. Even saving $200 more a month could mean $2,400 a year, which could grow even further if invested. Tracking shows you where to cut and how to channel that money into meaningful goals like building an emergency fund, paying off loans, or investing for retirement.

Guide to Track Your Spending

1. Choose a Tracking Method That Fits You

![]()

There are many tools available, but the best method is the one you’ll use consistently. If you love technology, an app that links to your bank accounts may be the easiest. If you prefer control, a simple spreadsheet lets you manually input and categorize expenses.

If you’re someone who learns visually, a paper notebook or journal can help you literally “see” your spending habits on paper. The important thing is to avoid overcomplicating it.

2. Record Every Expense

Commit to recording everything, no matter how small. It’s tempting to skip small transactions, but those often add up to the biggest leaks.

For example, buying snacks, fast food, or impulse shopping at the checkout line can total hundreds of dollars a month if untracked. By capturing every purchase, you’ll see the full picture of your money habits.

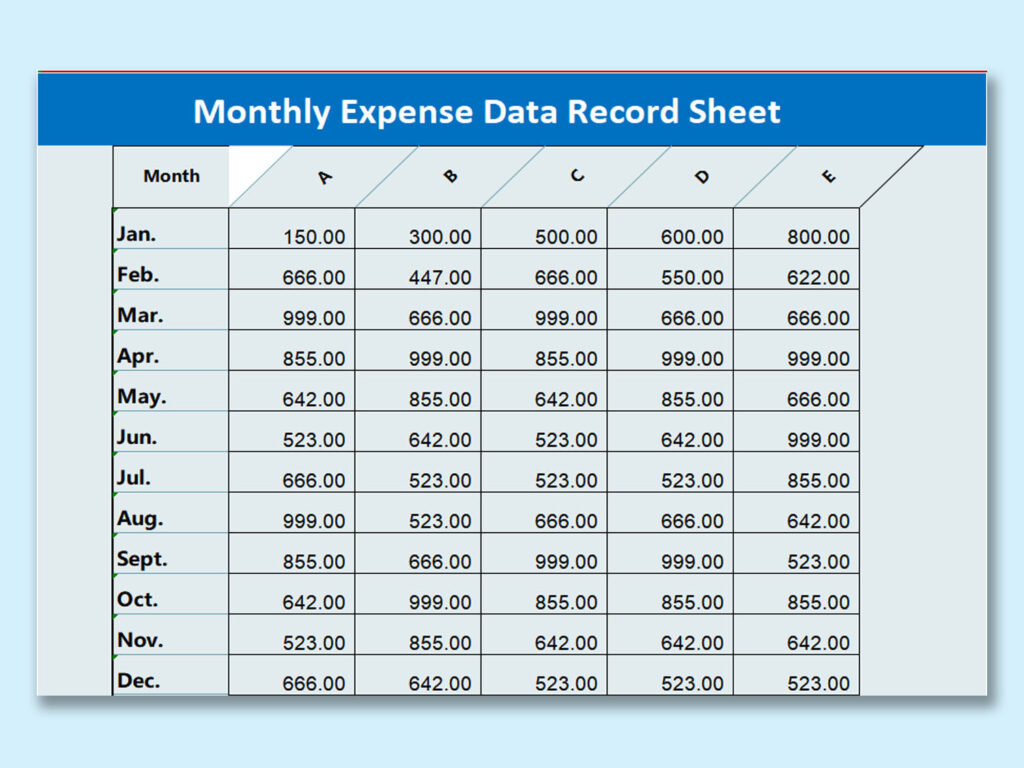

3. Categorize Your Spending

Breaking expenses into categories makes it easier to understand where your money is flowing. For example, you may think groceries are eating up your budget, but once you categorize, you might realize eating out or delivery apps are the real culprits.

Categories also help you set limits—knowing exactly how much you spend on “fun” each month makes it easier to keep it under control without cutting it out entirely.

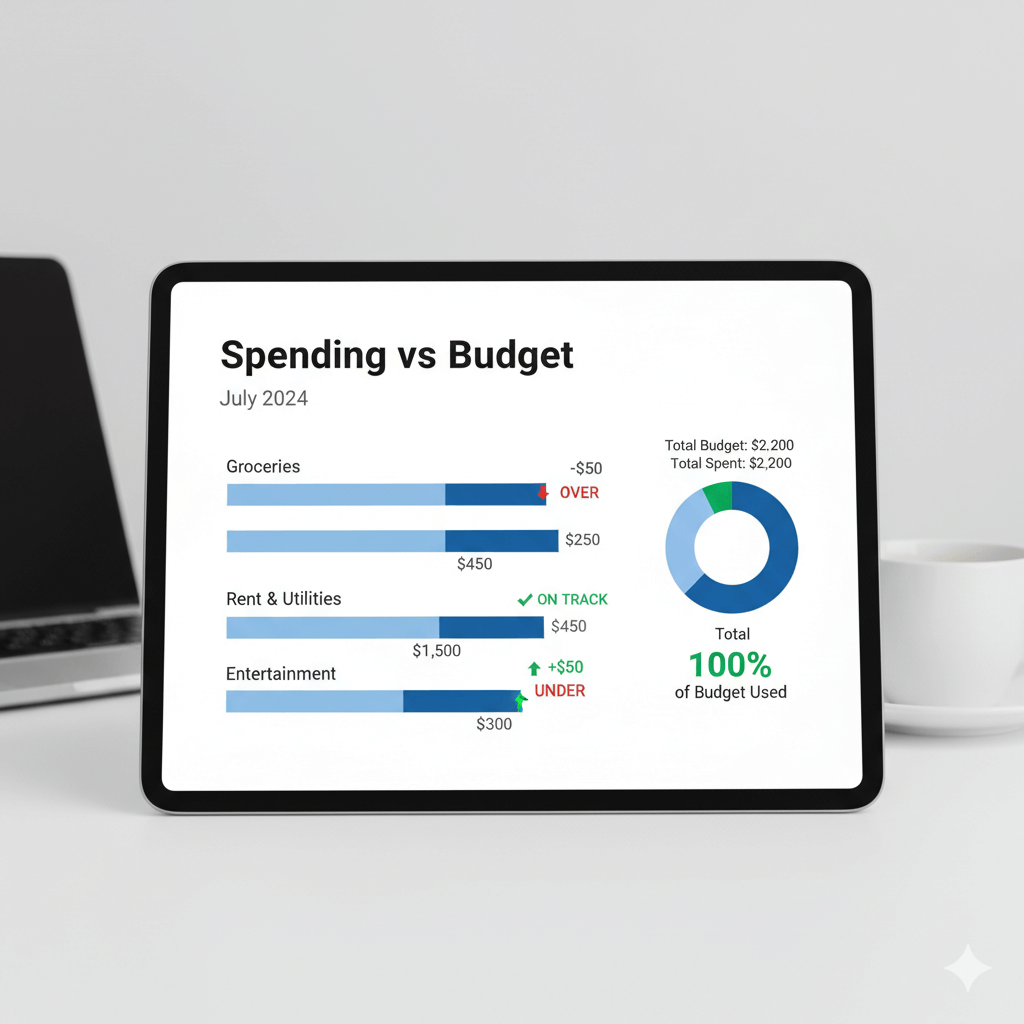

4. Compare Spending vs. Budget

After a month of tracking, compare your actual spending with your budget goals. This step is where most people are surprised—maybe you thought you only spent $100 on entertainment, but the numbers show $250. This comparison highlights where your expectations don’t match reality.

Instead of feeling guilty, use this knowledge to adjust your budget to be more realistic or commit to cutting back in certain areas.

5. Make Adjustments and Set Limits

Now that you know where the leaks are, it’s time to fix them. For example, if you spend too much on dining out, you could meal prep lunches or set a weekly dining budget. If subscription services are draining your account, cancel the ones you don’t use regularly.

A small automatic transfer into savings each payday ensures you pay yourself first. Adjustments don’t have to be extreme—even trimming $50–100 per category can free up a significant amount for savings.

Practical Tips to Stick With Tracking

- Do a Weekly Review: Set aside 10 minutes each week to check your expenses. Weekly reviews keep you accountable and prevent overspending from snowballing. Waiting until the end of the month makes it harder to adjust in time.

- Use Cash Envelopes: If you struggle to control discretionary spending, try the cash envelope method. Withdraw a set amount of cash for categories like entertainment or dining. When the envelope is empty, you know you’ve hit your limit—simple, visual, and effective.

- Set Spending Alerts: Most banking apps allow you to set alerts for certain spending levels. These notifications act like guardrails, keeping you mindful before you overshoot your budget. They’re especially helpful if you often forget to check your accounts.

- Reward Yourself: Budgeting shouldn’t feel like punishment. When you stick to your spending plan for a month, give yourself a small reward—like a nice meal or a fun activity—within your budget. Rewards reinforce good habits and make tracking more enjoyable.

The Immediate Benefits

Tracking your spending brings results quickly. Within just a few weeks, most people notice they’re spending less simply because they’ve become more conscious of where their money goes. This leads to greater confidence when making financial choices, less stress about bills, and more freedom to save toward goals like vacations, investments, or becoming debt-free. Even small improvements compound over time, making tracking one of the most valuable habits you can build.

Tracking your spending is the foundation of financial success. Without it, budgets fail, savings stall, and money seems to “disappear.” But once you commit to recording, categorizing, and reviewing your expenses, you take full control of your financial future.

Remember: it’s not about restricting yourself—it’s about aligning your spending with your goals. The sooner you start, the sooner you’ll beat your budget and begin saving more money right now.