Are you tired of feeling like saving money is an impossible task? Maybe you’ve tried the traditional methods, like setting aside a fixed amount each month, only to find it too difficult to stick to. If this sounds familiar, micro-saving might be the answer you’ve been looking for.

Micro-saving is a game-changing approach to building wealth, and the best part is it’s accessible to almost anyone. This comprehensive guide will walk you through the steps to start your micro-saving journey and make it a sustainable habit.

What is Micro-Savings?

Micro-saving is setting aside very small, frequent amounts of money. Instead of aiming to save a large chunk each month, you’ll focus on saving just a few dollars or cents at a time. The key is consistency – by making micro-savings a part of your daily routine, those small amounts can add up quickly and painlessly.

Benefits of Micro-Saving

There are several reasons why micro-saving is such an effective strategy:

- Low Barrier to Entry: Micro-saving doesn’t require significant disposable income, making it accessible to people of all income levels.

- Psychological Boost: The frequent small wins you’ll experience from your micro-savings can provide a powerful psychological boost, keeping you motivated to continue. You can check out our article on the psychology behind micro-saving.

- Habit Formation: Micro-saving taps into the power of habit formation, making it easier to stick to over the long term.

- Flexibility: Micro-saving can be easily adjusted to accommodate changes in your financial situation.

- Compound Interest: Even small amounts saved can benefit from compound interest over time, helping your money grow.

Steps to Start a Micro-Saving Habit

Ready to get started? Follow these seven steps to build a successful micro-saving routine:

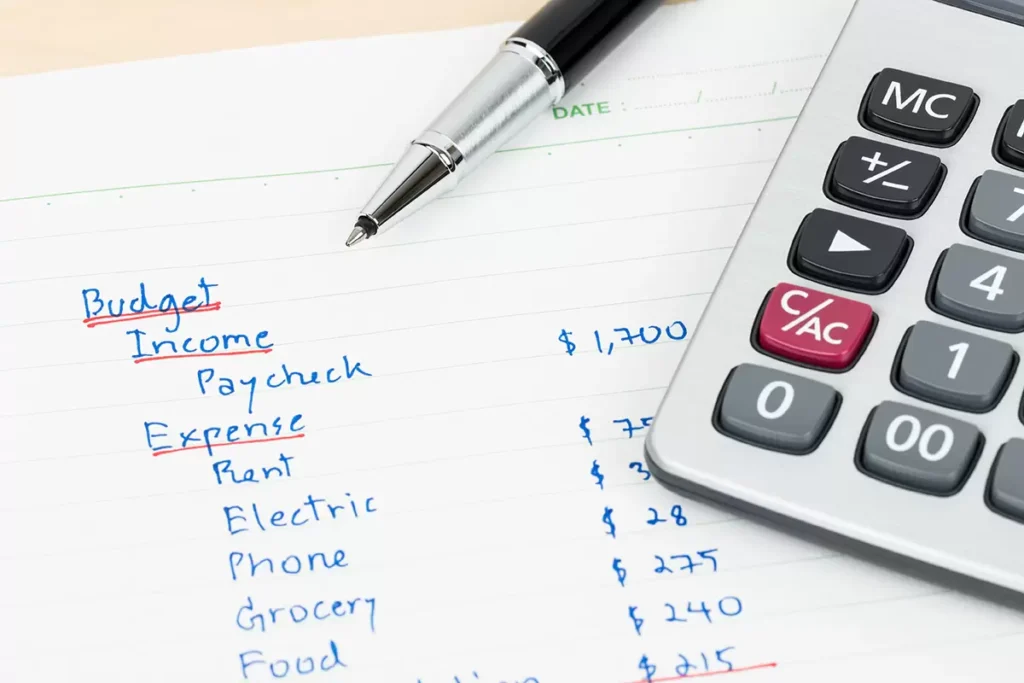

1. Assess Your Spending

Take a close look at your daily spending habits. Identify small, frequent purchases that you could quickly reduce or eliminate to free up money for micro-saving.

By understanding where your money goes, you can identify areas for improvement, make informed decisions, and set realistic financial goals.

2. Choose a Micro-Saving Method

There are several ways to approach micro-saving. Some popular options include:

- Rounding up purchases to the nearest dollar and saving the difference

- Automating small, daily transfers to a dedicated savings account

- Saving a tiny percentage of each paycheck or transaction

3. Start Small

When it comes to saving money, starting small is perfectly okay. It’s often the best approach. You don’t need to worry about setting aside large sums right away. Begin with a manageable amount, even if it’s just $1 or $2 per day.

The key is consistency. By making saving a daily habit, you build a strong financial foundation over time. These small amounts may seem insignificant, but they add up quickly and help you develop the discipline needed to save more as your financial situation improves.

The psychological benefit of seeing your savings grow, even slowly, can be incredibly motivating. It reinforces the habit and encourages you to keep going. As your confidence and financial awareness increase, you can gradually increase your savings.

So, don’t underestimate the power of small, consistent savings. It’s less about the amount you start with and more about the habit you’re building. Over time, this habit will become a crucial part of your financial success.

4. Automate It

Set up a regular automatic transfer from your checking account to your savings account. This could be daily, weekly, or monthly—whatever works best for you. Automating this process saves money before you can spend it, making it a seamless part of your routine. Even small amounts, like $5 a week, can add up over time without you even noticing.

Round-Up Features Many banks and apps offer round-up features, where your purchases are rounded to the nearest dollar, and the difference is automatically transferred to your savings.

For example, if you buy a coffee for $3.50, the transaction is rounded to $4, and the extra $0.50 is deposited into your savings account. It’s a painless way to save small amounts frequently, turning everyday transactions into opportunities to grow your savings.

5. Track Your Progress

Monitor your micro-savings regularly, whether through a dedicated app, spreadsheet or simply keeping a running tally. Seeing your progress can be incredibly motivating.

6. Adjust as Needed:

As your financial situation changes, be prepared to adjust your micro-saving strategy. You may be able to increase the amount you save over time, or you may need to scale back temporarily.

7. Celebrate Small Wins

Acknowledge and celebrate your micro-saving milestones, no matter how small. This will reinforce the positive habit and keep you engaged.

Overcoming Challenges and Staying Motivated

As with any new habit, you may face some challenges. Here are a few tips to help you stay on track:

- Adjust Your Micro-Saving Amount: If your saving amount feels too challenging to maintain, don’t be afraid to adjust it. The key is consistency, not the size of each contribution.

- Celebrate Small Wins: Recognize and appreciate each small milestone, whether reaching a savings goal or simply making your micro-saving a daily habit.

- Remind Yourself of the Benefits: Whenever you feel tempted to skip a micro-saving contribution, remember the long-term benefits, like building an emergency fund or saving for a big purchase.

- Enlist Support: Tell your friends and family about your micro-saving goals. Having a support system can make a big difference in staying motivated.

Micro-saving is a powerful tool for building wealth, and the best part is it’s accessible to everyone. Starting small, automating your savings, and celebrating your progress can turn micro-saving into a sustainable, lifelong habit.

Remember, the key to success is consistency. Don’t get discouraged if you miss a day or fall short of your goal – pick up where you left off and keep going. With time and dedication, those small savings will add up, and you’ll be well on your way to achieving your financial dreams.

So, what are you waiting for? Start your micro-saving journey today and watch your savings grow!