In today’s fast-paced digital world, saving money has never been easier, thanks to the rise of micro-saving apps and tools. These innovative platforms allow users to save small amounts of money regularly, often without noticing.

As we move into 2025, let’s explore some of the best micro-saving apps and tools available to help you build your savings effortlessly. You can also use our Micro Savings Calculator to get an idea about how much you can save based on the data you give to the tool.

Best Micro-Saving Apps and Tools

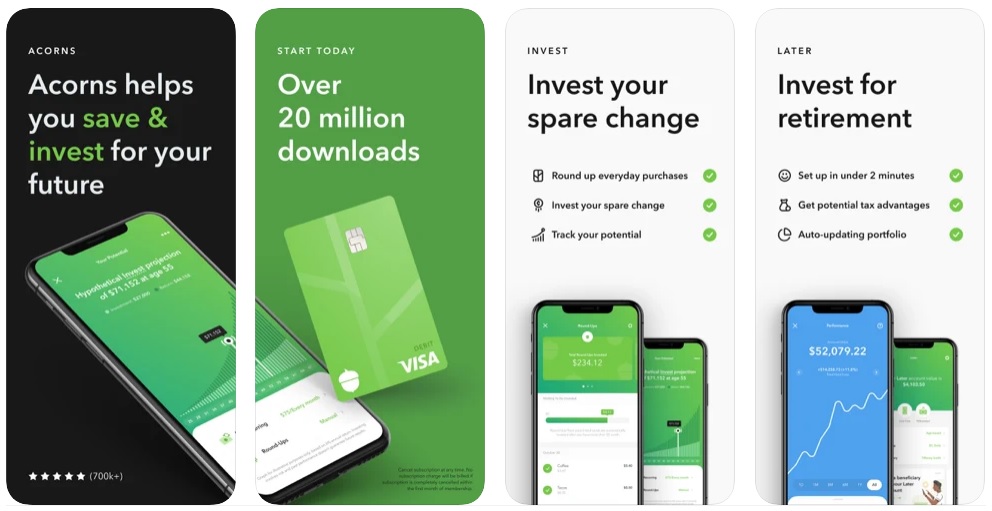

1. Acorns

Acorns is a popular micro-investing and savings app to help users invest their spare change. Here’s a quick rundown:

| Feature | Description |

|---|---|

| Core Feature | Rounds up purchases to the nearest dollar and invests the difference |

| Investment Options | Diversified portfolios of ETFs based on user risk tolerance |

| Additional Features |

|

| Education | Financial literacy resources through the “Grow” section |

| Costs | Monthly fee ($1-$5 depending on the plan) |

| Ideal For | Beginners who want an easy, automated way to start investing and saving |

| Limitations | Limited investment options compared to traditional brokerages |

Acorns simplifies investing for many users, but it’s essential to consider the fees and your financial goals when deciding if it’s the right tool.

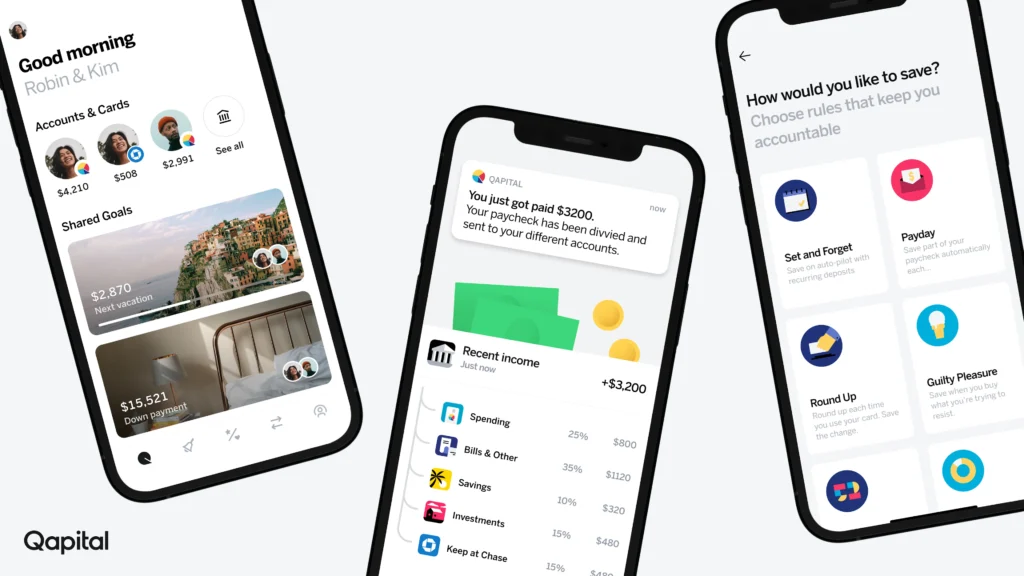

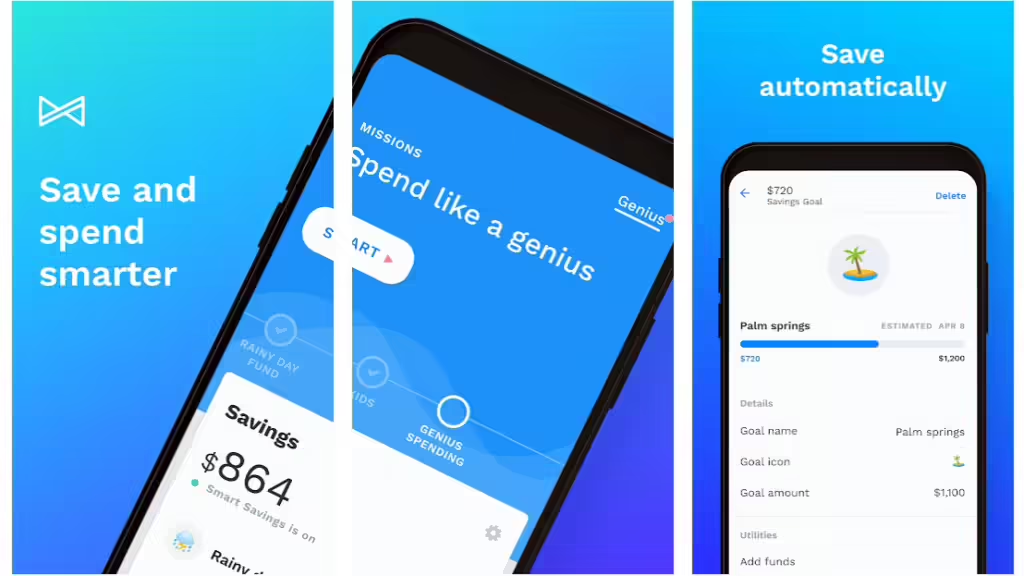

2. Qapital

Qapital is a financial app designed to help users save money in a fun and engaging way. It uses gamification techniques to make saving more enjoyable and attainable. By setting up automatic savings rules called “Goals,” users can easily save towards specific financial objectives.

Key Features of Qapital:

| Feature | Description |

|---|---|

| Goals | Customizable savings rules that automatically transfer money to specific savings accounts based on various triggers, such as spending habits, salary deposits, or special occasions. |

| Challenges | Gamified savings challenges that encourage users to save towards specific goals with rewards and incentives. |

| Round Ups | Automatically rounds up every purchase to the nearest dollar and transfers the difference to a savings account. |

| If/Then Rules | Create custom rules to automate savings based on specific conditions, such as saving a certain amount when a bill is paid or when a salary is deposited. |

| Spending Insights | Track spending habits and identify areas where savings can be optimized. |

| Financial Education | Access articles and resources to learn about personal finance and improve financial literacy. |

3. Chime

Chime is a mobile banking app that offers a variety of features designed to help users manage their finances more effectively. It is known for its fee-free approach and focus on providing accessible banking services.

| Feature | Description |

|---|---|

| Fee-free banking | Chime offers a free checking account with no monthly fees, overdraft fees, or foreign transaction fees. |

| Early direct deposit | Chime typically provides early access to direct deposit funds, often up to two days before payday. |

| Automated savings | Chime’s “Savings Mode” automatically rounds up purchases to the nearest dollar and deposits the difference into a linked savings account. |

| SpotMe | This overdraft protection program allows users to overdraw their accounts by a small amount (up to $100) without incurring fees. |

| Chime Credit Builder Visa Card | This secured credit card helps users build credit history by reporting monthly payments to credit bureaus. |

| Chime Debit Card | A fee-free debit card that can be used for purchases and ATM withdrawals. |

| Mobile check deposit | Users can deposit checks directly into their Chime account using their smartphone. |

| Bill pay | Chime allows users to pay bills directly from their accounts. |

Chime is popular for those looking for a convenient and affordable banking option. Its focus on fee-free services and user-friendly app makes it suitable for many people.

4. Trim

Trim is a personal finance app that helps users manage their finances more effectively. It offers a variety of features designed to save users money, including automatic bill negotiation, subscription management, and credit monitoring.

| Feature | Description |

|---|---|

| Automatic bill negotiation | Trim automatically negotiates with service providers to lower your bills for cable, internet, and mobile phone plans. |

| Subscription management | Trim helps you identify and cancel unused subscriptions, saving you money on recurring charges. |

| Credit monitoring | Trim monitors your credit report for changes and alerts you to any suspicious activity. |

| Budgeting tools | Trim provides budgeting tools to help you track your spending and identify areas where you can save money. |

| Debt management | Trim offers tools and advice to help you manage and reduce your debt. |

5. Albert: Budgeting and Banking

Albert is a personal finance app with budgeting, banking, and investment features. It is designed to help users manage their money more effectively and achieve their financial goals.

| Feature | Description |

|---|---|

| Budgeting | Albert provides budgeting tools to help you track your income and expenses, set financial goals, and identify areas where you can save money. |

| Banking | Albert offers a fee-free checking account with no monthly fees, overdraft fees, or foreign transaction fees. |

| Investing | Albert provides investment services, including automated investing and access to various investment options. |

| Financial advice | Albert offers personalized financial advice and recommendations based on your financial goals and situation. |

| Debt management | Albert provides tools and advice to help you manage and reduce your debt. |

Micro-saving apps and tools have revolutionized the way we approach saving money. These platforms help users build their savings without significant lifestyle changes by automating the process and making it virtually painless. Whether you’re looking to invest your spare change, set specific savings goals, or be more mindful of your spending, there’s an app tailored to your needs.

However, it’s essential to consider factors such as fees, security, and personal financial goals when choosing the right micro-saving tool. Remember, the best app is the one you’ll use consistently, so pick a platform that aligns with your habits and preferences.

Micro-saving apps are powerful tools in your financial arsenal, but they work best as part of a broader financial strategy. Combine these tools with sound financial practices, and you’ll be well on your way to achieving your savings goals in 2024 and beyond.

Micro-Saving Features in Modern Banking Apps

Many Modern banking apps now feature micro-saving tools that make saving effortless. These features automatically set aside small amounts of money—often by rounding up transactions to the nearest dollar and transferring the difference into a savings account or sub-account.

This “set it and forget it” approach turns everyday spending into a steady stream of savings without requiring manual intervention.

Key Elements of Micro-Saving Features:

- Automatic Rounding Up: Every purchase is rounded up, and the extra cents or dollars are saved. For example, a $3.75 coffee becomes $4.00, with $0.25 automatically saved.

- Goal-Based Savings: Users can set specific targets, such as an emergency fund or vacation, and the app directs micro-saved amounts toward those goals.

- Personalization and Insights: Advanced algorithms analyze spending habits, providing tailored saving recommendations and progress tracking.

- Gamification: Many apps use rewards, milestones, and visual progress bars to motivate users to save.

- Budget Integration: Micro-saving tools often work alongside budgeting features, helping users manage spending and improve overall financial health.

Overall, micro-saving features in modern banking apps simplify accumulating savings. By automating small, regular contributions, they empower users—especially those with tight budgets—to gradually build financial security without the stress of traditional saving methods.