Managing your money can feel overwhelming without the right tools. Bills, subscriptions, groceries, and daily spending often pile up, leaving you unsure where your paycheck went. That’s where expense tracker apps come in. These powerful budget tracker tools simplify the process of recording, categorising, and analysing your spending so you can stick to your budget and achieve your financial goals faster.

As a financial advisor, I recommend using personal finance apps to make money management easier, more consistent, and less stressful. Below, we’ll explore the best expense tracker apps, what makes each unique, their key features, and how to pick the one that suits your lifestyle.

Why Use an Expense Tracker App?

An expense tracker app helps you see exactly where your money goes each month, making it easier to stick to a budget and find areas where you can save. Instead of wondering why your bank account is empty, you’ll have a clear picture of your spending habits right on your phone.

The app automatically categorizes your expenses, tracks your financial goals, and alerts you when you’re overspending in certain areas.

This makes managing money less stressful and helps you make smarter financial decisions, whether you’re saving for something special, paying off debt, or just looking for better control over your finances.

Best Expense Tracker Apps

1. Mint

![]()

Mint is one of the most popular free budget tracker apps. It automatically syncs with your bank accounts, credit cards, and bills to give you a complete picture of your finances. Mint categorizes expenses, sets personalized budgets, and even monitors your credit score. With fraud alerts and financial insights, Mint is perfect for beginners looking for an all-in-one personal finance app.

Key Features:

- Free to use

- Syncs with bank and credit card accounts

- Automatic expense categorization

- Credit score monitoring

- Bill reminders and fraud alerts

- Custom budget creation

2. YNAB (You Need A Budget)

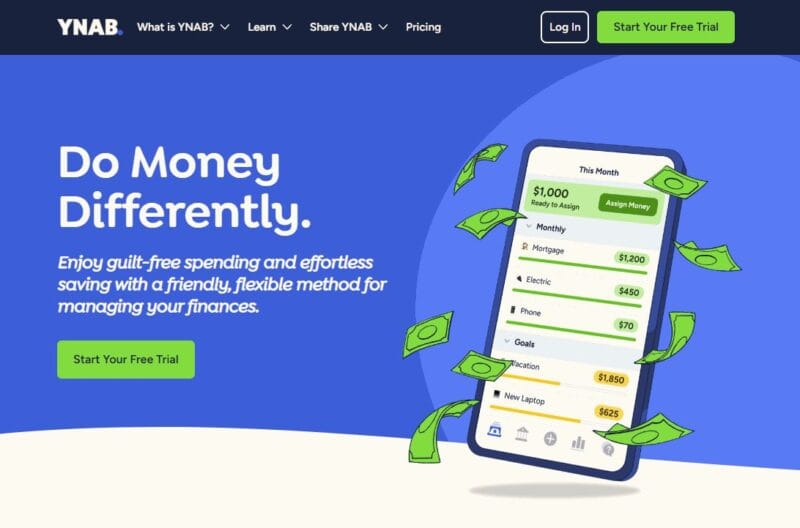

YNAB is more than an expense tracker app—it’s a full budgeting system. It encourages you to “give every dollar a job,” whether for bills, savings, or debt repayment. Unlike many free apps, YNAB is subscription-based, but users say the accountability is worth it. This budgeting app is ideal for those serious about breaking the paycheck-to-paycheck cycle and creating sustainable financial habits.

Key Features:

- Proactive budgeting system (“give every dollar a job”)

- Goal-setting tools for savings and debt repayment

- Real-time syncing across devices

- Detailed spending reports and insights

- Educational resources and workshops

- Free trial, then subscription-based

3. PocketGuard

PocketGuard simplifies money management with its “In My Pocket” feature, which shows how much disposable income you have after covering bills and savings goals. It’s also great for spotting recurring subscriptions you may want to cancel. If you want a money management app that offers quick, no-fuss insights into your spending, PocketGuard is a solid choice.

Key Features:

- “In My Pocket” disposable income tracker

- Automatic syncing with bank accounts

- Subscription and bill tracking

- Goal-setting for savings

- Basic free plan, with PocketGuard Plus for more features

4. Goodbudget

Goodbudget uses the envelope budgeting method, but in digital form. Instead of automatic syncing, you manually allocate funds into digital “envelopes” for expenses like groceries, rent, or dining out. This system makes you intentional with spending. Goodbudget is an excellent budget tracker for couples or families who want to manage shared finances without syncing bank accounts.

Key Features:

- Envelope-style budgeting system

- Shared budgeting for couples/families

- Manual expense tracking (no direct syncing)

- Expense reports and history tracking

- Free and paid versions available

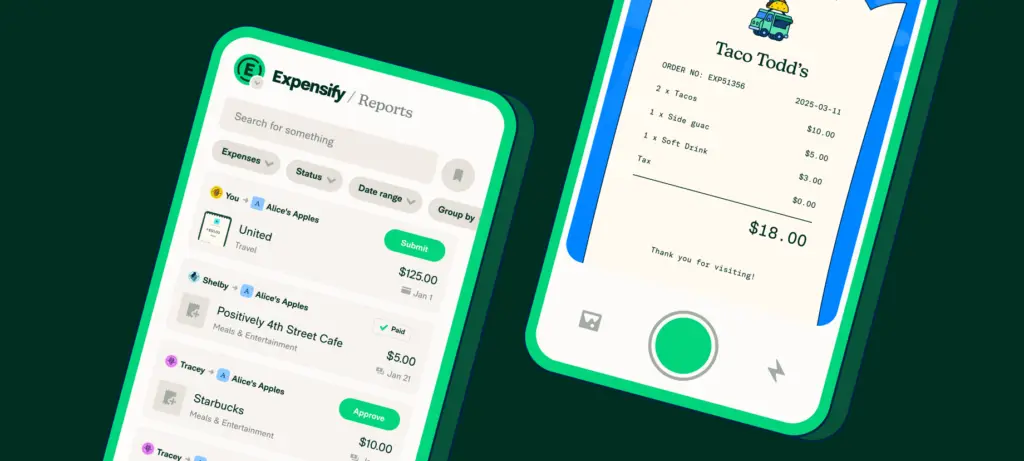

5. Expensify

Expensify shines as both a personal and business expense management app. It allows you to scan receipts, automatically extracts expense details, and generates detailed reports. This makes it ideal for freelancers, small business owners, or frequent travellers who need a receipt tracker and budget tracker in one.

Key Features:

- Receipt scanning with SmartScan technology

- Automatic expense categorisation

- Expense report generation

- Multi-currency support

- Integrates with accounting software (QuickBooks, Xero, etc.)

- Free for individuals, business plans available

6. Spendee

Spendee combines vibrant visuals with powerful budgeting tools. You can create shared wallets for family or roommates, making it perfect for managing group expenses. With multi-currency support, it’s also a top choice for international users. Spendee is the best budget tracker app for those who prefer a clean design and collaborative money management.

Key Features:

- Shared wallets for group budgeting

- Multi-currency support (great for travellers)

- Sync with bank accounts or track manually

- Expense categorisation with visual charts

- Free and premium versions

Comparison Table: Best Expense Tracker Apps

| App | Best For | Price Model | Key Features |

|---|---|---|---|

| Mint | Beginners wanting an all-in-one app | Free | Bank sync, credit score monitoring, bill alerts, custom budgets |

| YNAB | Serious long-term budgeters | Paid (free trial first) | “Give every dollar a job,” real-time syncing, detailed reports |

| PocketGuard | Quick insights & subscription tracking | Free + Paid version | “In My Pocket” feature, bill/subscription tracking, goal-setting |

| Goodbudget | Couples/families, envelope system | Free + Paid | Digital envelope budgeting, shared budgeting, and manual tracking |

| Expensify | Freelancers & business users | Free + Business plans | Receipt scanning, expense reports, and accounting integrations |

| Spendee | Families/groups, international | Free + Premium | Shared wallets, multi-currency support, and visual charts |

Expense tracker apps are more than digital notebooks—they’re essential tools for smarter money management. By using the right budget tracker app consistently, you’ll not only understand where your money goes but also gain control over your spending, save more, and reach your financial goals faster.

Remember: apps don’t change habits—you do. But with the right personal finance app in your pocket, sticking to your budget and saving money becomes a lot easier. Start today, and watch your financial confidence grow.