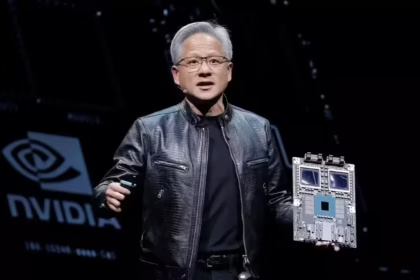

U.S. stocks finished lower on Thursday as investors digested the long-awaited September jobs data, which offered a mixed picture of the labour market. Tech shares led the retreat, with Nvidia (NVDA) reversing strong early gains from its blowout earnings report and ending the day down 3.2%.

Nvidia’s slide made it one of the weaker performers in the Dow, which fell 0.8%. The S&P 500 dropped 1.6%, and the Nasdaq sank 2.2%, weighed down heavily by the pullback in tech stocks.

Other AI-focused chipmakers also stumbled. AMD plunged nearly 8%, Broadcom (AVGO) slipped about 2%, and the PHLX Semiconductor Index shed almost 5%. Nvidia partner Micron (MU) posted one of the sharpest declines of the group, falling 10.9%.

Jacobs Solutions (J) was the worst performer in the S&P 500, sliding nearly 11% after reporting lower quarterly profits compared to last year. The company attributed the drop in part to changes in the valuation of its stake in Amentum (AMTM), which it spun off last year as part of a restructuring of its intelligence, cyber, and critical mission operations.

Crypto-related assets also struggled. Bitcoin extended its recent slide, hovering around $87,000. Stocks tied to crypto trading followed suit—Robinhood (HOOD) plunged roughly 10%, while Coinbase (COIN) dropped 7.4%.

One standout gainer was Walmart (WMT). Shares jumped nearly 7%, topping the S&P 500 after the retailer posted stronger-than-expected quarterly earnings. Growth in e-commerce and advertising revenue helped fuel the beat, offering a potentially encouraging sign for consumer spending as the holiday season approaches.

In biotech, Regeneron (REGN) rose about 5% after receiving FDA approval for its Eylea HD treatment for macular edema linked to retinal vein occlusion. The agency also approved a monthly dosing schedule for Eylea HD for multiple eye conditions.

Meanwhile, Solventum (SOLV)—the health-care company spun off from 3M—gained close to 3% after announcing plans to acquire Acera Surgical, a regenerative wound-care firm, for $725 million in cash, with up to $125 million more tied to performance milestones.