Nvidia CEO Jensen Huang believes artificial intelligence has reached a self-sustaining stage of progress — a “virtuous cycle” that will keep the industry expanding for years to come.

Speaking at the Asia-Pacific Economic Cooperation (APEC) CEO Summit in South Korea, Huang explained that as AI models improve, they attract greater usage and investment, which then fuels even more innovation and capability.

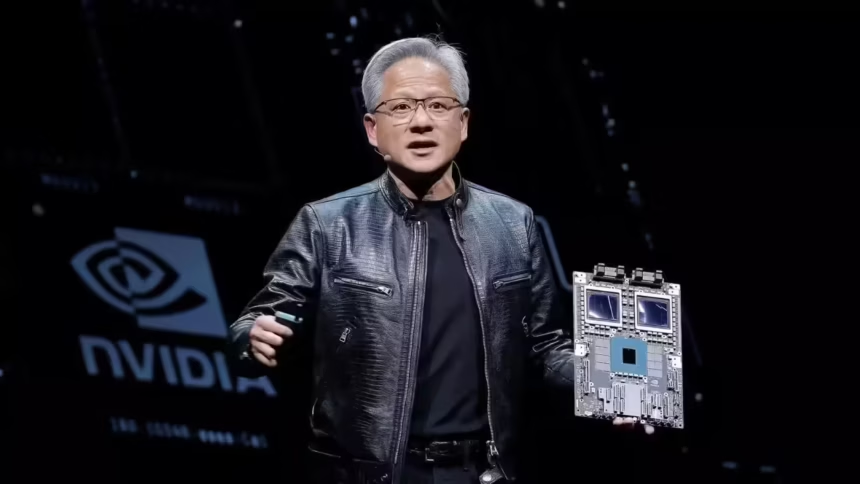

“We’ve now achieved what is called the virtuous cycle,” Huang told the audience, notably trading his trademark black leather jacket for a suit. “The AIs get better, more people use them, which leads to more profits and more factories — and those factories create even better AIs. This cycle is why you’re seeing capital expenditures rise so quickly worldwide.”

Big Tech’s Massive AI Spending Spree

Huang’s remarks come amid an unprecedented wave of investment in AI infrastructure. Tech giants such as Meta, Amazon, Alphabet, and Microsoft are collectively pouring over $300 billion into artificial intelligence and data centre expansion throughout 2025 — and that figure is expected to grow even further in 2026.

According to Dan Ives, global head of technology research at Wedbush Securities, Nvidia sits at the center of this explosive trend.

“Nvidia is the foundation of the AI revolution,” Ives told CNBC. “The more demand there is for AI, the more companies invest in its core technologies. Demand creates more demand, and capital expenditure follows.”

Huang reinforced that profitability is the key driver behind this accelerating cycle.

“When something becomes profitable, you manufacture more of it,” he explained. “It’s the same as chips, wafers, or DRAM — when production yields returns, companies build more factories to make even more.”

A New Era of Computing

Huang described this moment as the dawn of a new computing era, one that fundamentally redefines every layer of the technology stack.

“AI runs on GPUs, while traditional software runs on CPUs,” he said. “From the chips and infrastructure to the energy systems, software, and AI models — every single layer of computing is being transformed.”

He noted that for decades, the computer industry had remained structurally consistent, but now, the shift to AI-driven and accelerated computing requires an overhaul of the world’s computing infrastructure.

“All of the computers we’ve built — trillions of dollars’ worth — must now transition to this new computing platform,” Huang said.

Global Partnerships and the Future of AI

Nvidia, which recently became the first company to exceed $5 trillion in market value, also announced a major partnership with Samsung during the event. The Korean tech giant plans to deploy a cluster of 50,000 Nvidia GPUs to enhance its semiconductor manufacturing for mobile devices and robotics.

Huang envisions a future where AI evolves from being a mere tool to a productive worker — powering automated factories and reshaping industries worth over $100 trillion worldwide.

“We’re at the start of a 10-year buildout,” Huang concluded. “AI is not just transforming computing — it’s transforming work, industry, and the global economy itself.”