Shares of Advanced Micro Devices fell 12% on Wednesday after the chipmaker issued first-quarter guidance that, while above consensus estimates, failed to meet the most optimistic expectations on Wall Street.

AMD reported fourth-quarter revenue of $10.27 billion on Tuesday, comfortably beating analyst forecasts compiled by LSEG, which had projected $9.67 billion. The results capped a year of rapid growth for the company, driven largely by surging demand for processors used in artificial intelligence and data center workloads.

Looking ahead, AMD said it expects revenue of approximately $9.8 billion for the first quarter, with a margin of plus or minus $300 million. That figure exceeded the average market estimate of $9.38 billion. However, investors appeared to be looking for stronger guidance amid an ongoing boom in spending on AI infrastructure.

High Expectations Weigh on the Stock

Analysts pointed out that the reaction reflected elevated expectations rather than a deterioration in fundamentals. Chris Rolland, a semiconductor analyst at Susquehanna, said investor sentiment had been set extremely high going into the report.

“First, expectations were pretty sky high,” Rolland said during an appearance on CNBC. He also noted that AMD disclosed revenue from shipments to China during the quarter that had not been factored into many analysts’ models, making the headline beat appear less impressive once adjusted.

Despite the market’s reaction, Rolland emphasized that demand for AMD’s data center chips remains strong and suggested the company is positioning itself for large-scale contracts in the future.

AI Momentum Remains Intact

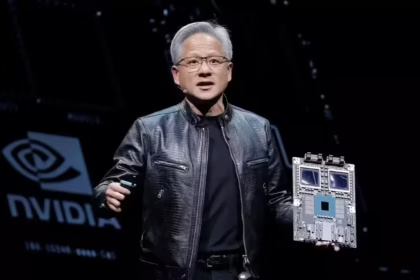

AMD has been one of the primary beneficiaries of the global AI investment surge, alongside Nvidia. Over the past year, AMD shares have risen more than 100%, reflecting investor confidence in its expanding role in AI computing.

That confidence is supported by a series of high-profile partnerships announced in recent months. In October, AMD revealed a major agreement with OpenAI, under which the AI startup could take up to a 10% stake in the chipmaker. As part of the deal, OpenAI plans to deploy as much as 6 gigawatts of AMD’s Instinct graphics processing units over several years, starting with an initial 1-gigawatt rollout in the second half of 2026.

AMD has also secured commitments from major cloud providers. Oracle announced in October that it intends to deploy 50,000 AMD AI chips beginning later this year, further strengthening the company’s position in the data center market.